Budget Like a Boss: Realistic Budgeting Tips for Freelancers

Creating a realistic budget with an irregular income, typical for freelancers and gig workers, involves tracking income, prioritizing essential expenses, setting financial goals, and adjusting your budget as needed to achieve financial stability.

Navigating the world of freelancing or gig work comes with its own unique set of challenges, and one of the biggest is managing an irregular income. But don’t worry; learning how to create a realistic budget when you have irregular income: tips for freelancers and gig workers is easier than you think.

Understanding Irregular Income: The Freelancer’s Reality

For freelancers and gig workers, income isn’t always predictable. Some months may bring a financial windfall, while others might be leaner. Understanding this fluctuation is the first step toward creating a budget that works for you.

It’s all about embracing the unpredictability and building a financial plan that’s flexible enough to handle the highs and lows of your income stream.

Why Traditional Budgeting Often Fails for Freelancers

Traditional budgeting methods, which rely on a consistent monthly income, can be frustrating and ineffective for those with variable earnings. Static budgets don’t account for the income roller coaster that many freelancers experience.

Attempting to stick to a strict, unchanging budget can lead to feelings of failure and discouragement.

- Inflexibility: Standard budgets don’t easily adjust to income changes.

- Unrealistic expectations: Setting fixed spending limits can be difficult when income varies.

- Missed opportunities: Sticking to a rigid plan may prevent you from capitalizing on unexpected income surges.

To create a budget that truly works, you need a dynamic approach that adapts to your unique financial situation.

Step 1: Track Your Income and Expenses Meticulously

The foundation of any successful budget, especially with an irregular income, is a clear understanding of your financial inflows and outflows. This means tracking every dollar you earn and spend.

Consider this the detective work that sets you up for financial success.

Tools and Apps for Tracking Finances

Luckily, there are numerous tools and apps to make tracking your income and expenses a breeze. Take advantage of these technological advancements to streamline your financial management.

Consider apps like Mint, YNAB (You Need a Budget), or Personal Capital to monitor your financial activity.

- Mint: A free app that connects to your bank accounts and credit cards, automatically categorizing transactions.

- YNAB: A subscription-based app that encourages proactive budgeting and helps you allocate every dollar.

- Personal Capital: An app that provides a comprehensive view of your finances, including budgeting, investment tracking, and net worth analysis.

Choose the tool that best fits your needs and preferences to stay on top of your finances effectively.

By meticulously tracking your income and expenses, you’ll gain valuable insights into your spending habits and identify areas where you can make adjustments.

Step 2: Calculate Your Average Monthly Income

While your income may fluctuate, calculating your average monthly income provides a baseline for budgeting. This gives you a more stable figure to work with when planning your expenses.

It’s time to crunch some numbers and get a clearer picture of your earning potential.

Using Historical Data to Predict Future Earnings

Gather your income data from the past 6-12 months to get an accurate representation of your average monthly earnings. This historical data will serve as the foundation for your budget.

Consider using a spreadsheet or budgeting app to track your income over time.

- Spreadsheet: Create a simple spreadsheet with columns for each month and your income for that month.

- Budgeting app: Utilize the reporting features of your budgeting app to track your income trends.

Analyzing historical data can also help you identify seasonal trends or patterns in your income.

Once you have this average, you can use it as a guide for setting your spending limits, remembering to adjust for any anticipated fluctuations.

Step 3: Prioritize Essential Expenses

With an irregular income, it’s crucial to prioritize essential expenses. These are the costs you absolutely must cover each month, such as rent, utilities, food, and transportation.

Think of these as the non-negotiables of your financial life.

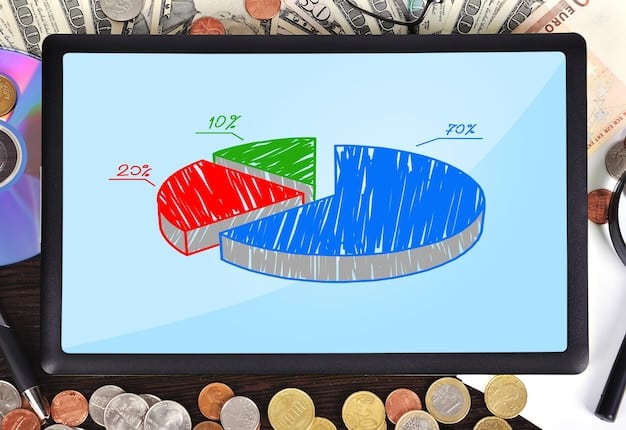

The 50/30/20 Rule for Freelancers

The 50/30/20 rule can be a helpful framework for prioritizing your spending. Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

This rule provides a simple guideline for managing your money effectively.

- Needs (50%): Essential expenses like rent, utilities, transportation, and groceries.

- Wants (30%): Non-essential expenses like dining out, entertainment, and hobbies.

- Savings/Debt Repayment (20%): Savings goals like emergency funds, retirement accounts, and debt repayment.

Remember that this is just a guideline, and you may need to adjust the percentages based on your unique circumstances.

By focusing on essential expenses first, you can ensure that your basic needs are met, even during months with lower income.

Step 4: Build an Emergency Fund

An emergency fund is a crucial safety net for freelancers with irregular income. It provides a cushion to cover unexpected expenses or income shortfalls without derailing your budget.

Consider it your financial security blanket for those unpredictable times.

How Much to Save in Your Emergency Fund

Ideally, you should aim to save 3-6 months’ worth of essential living expenses in your emergency fund. This may seem like a daunting goal, but start small and gradually build up your savings.

Even a small emergency fund can provide peace of mind and prevent you from accumulating debt.

- Start small: Set a goal to save $1,000 as a starter emergency fund.

- Automate savings: Set up automatic transfers from your checking account to your savings account each month.

- Adjust as needed: Re-evaluate your emergency fund goals as your income and expenses change.

Continuously growing your emergency fund will give you the confidence to handle unexpected financial challenges.

An emergency fund is your best defense against financial stress, especially when your income is unpredictable.

Step 5: Set Realistic Financial Goals

Setting clear financial goals can help you stay motivated and focused on your budget. These goals can range from short-term objectives like saving for a vacation to long-term aspirations like retirement planning.

Think of these goals as your financial North Star, guiding your spending decisions.

Short-Term vs. Long-Term Goals

Distinguish between short-term and long-term goals to create a comprehensive financial plan. Short-term goals can be achieved within a year, while long-term goals may take several years to accomplish.

Examples of short-term goals include saving for a down payment on a car or paying off a small debt.

- Short-term goals: Vacation savings, debt repayment, education expenses.

- Long-term goals: Retirement savings, homeownership, investment portfolio growth.

Break down your long-term goals into smaller, more manageable steps to make them feel less overwhelming.

Regularly review and adjust your financial goals to align with your evolving priorities and circumstances.

Step 6: Adjust Your Budget Regularly

An irregular income requires a flexible budget that can adapt to changing financial realities. This means reviewing and adjusting your budget regularly, at least once a month.

Think of your budget as a living document that evolves with your income.

Reviewing and Adapting to Income Fluctuations

When your income is higher than anticipated, seize the opportunity to allocate extra funds to your emergency fund, debt repayment, or savings goals. Conversely, when income is lower, cut back on non-essential expenses to stay on track.

Create a buffer in your budget to absorb unexpected income fluctuations.

- Monthly review: Dedicate time each month to review your income, expenses, and budget.

- Adjust spending: Identify areas where you can cut back during low-income months.

- Maximize savings: Allocate extra funds to savings goals during high-income months.

Keeping a close eye on your financial situation will enable you to quickly respond to changing circumstances.

Flexibility is key to maintaining financial stability when dealing with an irregular income.

| Key Point | Brief Description |

|---|---|

| 📊 Track Income/Expenses | Meticulously record all income and expenses to understand cash flow. |

| 💰 Calculate Avg. Income | Determine your average monthly income for budgeting. |

| ✅ Prioritize Essentials | Allocate funds to essential expenses first. |

| 🛡️ Build Emergency Fund | Create a financial safety net for unexpected expenses. |

Frequently Asked Questions

▼

Begin by documenting every payment you receive, regardless of the amount. Use a spreadsheet or a budgeting app to log the date, source, and amount of each payment. Over time, this will give you a clearer picture of your income patterns.

▼

Gather your income data from the past 6-12 months. Add up your total income for that period and divide it by the number of months. This will give you a reasonable estimate of your average monthly earnings.

▼

List all your expenses and categorize them as essential or non-essential. Focus on covering essentials like rent, utilities, and food first. Cut back on non-essential expenses to make ends meet during low-income months.

▼

Start small by setting a savings goal, even if it’s just a few dollars each week. Automate your savings by setting up recurring transfers to your savings account. Treat your emergency fund as a non-negotiable expense in your budget.

▼

Aim to review and adjust your budget at least once a month, or even more frequently if your income fluctuates significantly. This will help you stay on track and adapt to changing financial circumstances.

Conclusion

Creating a realistic budget with an irregular income requires a combination of careful tracking, strategic prioritization, and continuous adaptation. By tracking your income and expenses, understanding your average monthly earnings, and building an emergency fund, you can achieve financial stability and peace of mind, even in the unpredictable world of freelancing and gig work.