Budgeting for Beginners: Save $500 in Your First Month

Budgeting for beginners involves creating a detailed spending plan to track income and expenses, identify areas for savings, and set financial goals. Following a step-by-step guide can help you save $500 in your first month by optimizing your spending habits.

Embarking on a journey to financial stability can seem daunting, especially if you’re new to budgeting. However, with the right approach, budgeting for beginners can be straightforward and rewarding. This step-by-step guide is designed to help you track your expenses effectively and save $500 in your first month!

Understanding the Basics of Budgeting

Before diving into the specifics, it’s essential to grasp the core concepts of budgeting. Budgeting isn’t just about restricting spending; it’s about understanding where your money goes and making informed decisions about how to allocate it. Creating a budget allows you to take control of your finances, identify areas where you can save, and work towards your financial goals.

Why is Budgeting Important?

Budgeting provides a clear picture of your financial health, allowing you to see exactly how much money you’re earning and spending. This awareness is the first step towards making positive changes and achieving financial stability.

Key Components of a Budget

A well-structured budget typically includes income, expenses (both fixed and variable), and savings goals. Understanding these components is crucial for creating a budget that works for you.

- Income: This is the money you receive regularly, such as your salary, wages, or any other sources of revenue.

- Fixed Expenses: These are costs that remain consistent each month, like rent, mortgage payments, and loan repayments.

- Variable Expenses: These expenses change from month to month and can include groceries, entertainment, and utility bills.

- Savings Goals: Setting specific savings targets, such as saving $500 in your first month, provides motivation and direction for your budgeting efforts.

By understanding these basic elements, you can begin to create a budget that aligns with your financial goals and lifestyle.

Step 1: Calculate Your Income

The first step in effective budgeting is to determine your total income. This involves accounting for all sources of revenue, ensuring an accurate foundation for your budget.

Documenting All Income Sources

Start by listing all sources of income. This might include your primary job, any side hustles, investments, or other regular income streams. Be thorough to ensure an accurate representation of your financial resources.

Calculating Net Income

Net income, or take-home pay, is what remains after taxes and other deductions. This is the actual amount you have available for budgeting. Review your pay stubs or bank statements to determine your net income accurately.

Dealing with Irregular Income

If your income varies from month to month, calculate an average income based on the past few months. This average can provide a more stable figure for budgeting purposes. Adjust your budget as needed when your actual income fluctuates.

Calculating your income accurately is a foundational step, providing a clear starting point for managing your finances effectively.

Step 2: Track Your Expenses

Once you know your income, the next crucial step is to track your expenses. Understanding where your money is going is essential for identifying areas where you can cut back and save.

Methods for Tracking Expenses

There are several methods you can use to track your expenses, each with its own advantages. Choose the method that best suits your lifestyle and preferences.

- Budgeting Apps: Apps like Mint, YNAB (You Need a Budget), and Personal Capital can automatically track your spending by linking to your bank accounts and credit cards.

- Spreadsheets: Creating a spreadsheet in Excel or Google Sheets allows you to manually enter and categorize your expenses.

- Notebook and Pen: A simple notebook can be used to record your expenses as you go.

Categorizing Your Expenses

To get a clear picture of your spending habits, categorize your expenses into different groups. Common categories include housing, transportation, food, utilities, entertainment, and debt payments.

Differentiating Fixed and Variable Expenses

As mentioned earlier, fixed expenses remain consistent each month, while variable expenses fluctuate. Identifying these differences can help you prioritize and manage your spending more effectively.

Tracking your expenses provides valuable insights into your financial habits, enabling you to make informed decisions and identify areas for potential savings.

Step 3: Create a Realistic Budget

With your income and expenses tracked, you can now create a realistic budget. This involves allocating your income to different spending categories and setting limits to ensure you’re not overspending.

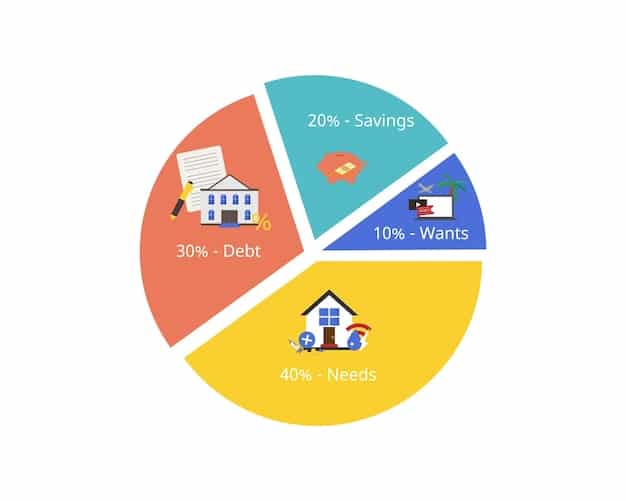

The 50/30/20 Rule

A popular budgeting method is the 50/30/20 rule. This approach suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

Adjusting the Budget to Fit Your Needs

While the 50/30/20 rule is a useful guideline, it’s important to adjust it to fit your specific circumstances. For example, if you have high debt payments, you may need to allocate a larger percentage to debt repayment.

Creating a realistic budget is a dynamic process that requires ongoing adjustments to align with your financial goals and lifestyle.

Step 4: Identify Areas to Cut Back

To save $500 in your first month, you’ll need to identify areas where you can cut back on spending. This often involves making some tough decisions, but the results can be well worth the effort.

Reviewing Spending Habits

Take a close look at your spending habits and identify any non-essential expenses that can be reduced or eliminated. This might include dining out, entertainment, or subscriptions.

Finding Alternatives to Expensive Habits

Consider finding cheaper alternatives to your expensive habits. For example, instead of buying coffee every day, make it at home. Instead of going to the movies, have a movie night at home with friends.

By identifying and addressing areas where you can cut back, you can significantly increase your savings and reach your goal of saving $500 in your first month.

Step 5: Set Specific Financial Goals

Setting specific financial goals can provide the motivation you need to stick to your budget. These goals should be clear, measurable, achievable, relevant, and time-bound (SMART).

Defining Short-Term and Long-Term Goals

Short-term goals might include saving for a vacation or paying off a small debt. Long-term goals could include saving for retirement or buying a home.

Prioritizing Your Goals

Prioritize your goals to determine which ones are most important to you. This will help you allocate your resources effectively and stay focused on what matters most.

Setting and prioritizing financial goals provides a clear roadmap for your financial future, making it easier to stay motivated and on track with your budget.

Step 6: Monitor and Adjust Your Budget Regularly

Budgeting is not a one-time task; it’s an ongoing process. You need to monitor your budget regularly and make adjustments as needed to ensure it remains effective.

Tracking Your Progress

Use your chosen method (budgeting app, spreadsheet, or notebook) to track your progress and see how well you’re sticking to your budget. This will help you identify any areas where you’re struggling and need to make adjustments.

Making Necessary Adjustments

Life changes, and your budget should too. Whether it’s a change in income, unexpected expenses, or shifting priorities, be prepared to make adjustments to your budget as needed.

Regular monitoring and adjustments are essential for maintaining a successful budget and achieving your financial goals.

| Key Point | Brief Description |

|---|---|

Calculate Income Calculate Income |

Determine all sources of revenue to know your financial foundation. |

Track Expenses Track Expenses |

Use apps or spreadsheets to monitor where your money goes. |

Set Financial Goals Set Financial Goals |

Define specific, measurable, and achievable financial targets. |

Cut Back Spending Cut Back Spending |

Identify and reduce non-essential expenses to save more. |

Frequently Asked Questions (FAQ)

Conclusion

By following these steps, budgeting for beginners can become a manageable and rewarding process. Take the time to implement these strategies, monitor your progress, and adjust your budget as needed to achieve your financial goals and save $500 in your first month. Good luck!