College Tuition Costs Up 7% in 2025: Strategies to Save

A new report projects college tuition costs to increase by 7% in 2025, creating urgent need for effective financial planning and strategic savings for prospective students and their families to mitigate the rising expenses.

The landscape of higher education in the United States is continuously evolving, and one constant concern for students and families is the relentless rise in tuition fees. A new report projects college tuition costs to increase by 7% in 2025, signaling an urgent need for proactive planning and smart financial strategies. This impending hike could significantly impact college accessibility and affordability, pushing many to re-evaluate their educational investment amidst a dynamic economic environment.

Understanding the Projected 7% Tuition Increase

The recent projection of a 7% increase in college tuition costs for 2025 is a critical piece of information for anyone planning higher education. This figure isn’t just a number; it represents a tangible shift in college affordability, impacting everything from application decisions to financial aid strategies. Understanding the drivers behind this projection is key to preparing for its implications.

Several factors contribute to these rising expenses. Inflation, while a general economic phenomenon, heavily influences operational costs for universities, including faculty salaries, administrative expenses, and facility maintenance. Additionally, the increasing demand for specialized programs and state-of-the-art facilities often requires significant investment, which is frequently passed on to students through tuition hikes. Fewer state subsidies for public universities also mean institutions rely more heavily on tuition to cover their budgets.

This projected increase follows a historical trend of rising college costs that has outpaced inflation for decades. While 7% might seem like a manageable single-year jump, its cumulative effect over a four-year degree can be substantial, transforming a seemingly affordable education into a significant financial burden. This highlights the importance of not just reacting to immediate changes but understanding the broader economic context.

Economic Factors Fuelling the Hike

Understanding the underlying economic forces is crucial to grasping why tuition costs continue their upward trajectory. It’s not just institutional greed, but a complex interplay of market dynamics, government policy, and university expenditures.

- Inflationary Pressures: The general increase in prices affects educational institutions just as it does households. Everything from utilities to textbooks becomes more expensive, forcing universities to adjust their pricing.

- Decreased State Funding: Many public universities have seen a reduction in state appropriations over the years, leading them to rely more on tuition fees to cover operational costs. This shifts the financial burden from taxpayers to students.

- Demand for Facilities and Technology: Modern education demands cutting-edge laboratories, advanced technological infrastructure, and comfortable living spaces. These amenities are expensive to build and maintain, and their costs are often incorporated into tuition.

Moreover, the reputation and perceived value of a degree from a particular institution can also play a role. Universities with strong brand recognition and high rankings often have more leeway to increase tuition, as the demand for admission remains high regardless of cost.

The ripple effect of such increases is wide-reaching. It challenges the traditional concept of college as a pathway to upward mobility, potentially creating barriers for students from lower and middle-income backgrounds. It also puts immense pressure on government and private entities to develop more robust financial aid programs.

Ultimately, the 7% increase is a stark reminder that the financial planning for higher education must be dynamic and adaptable, always considering the potential for significant cost adjustments. It’s a call to action for families to review their savings strategies and explore all possible avenues for financial assistance, understanding that the cost of inaction could be substantial.

Decoding the Impact on Students and Families

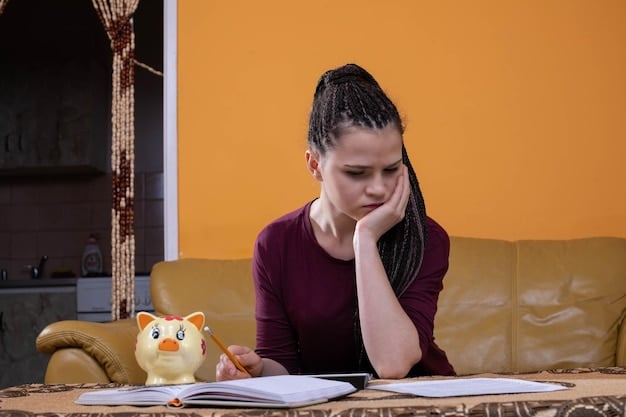

The projected 7% increase in college tuition for 2025 isn’t just an abstract statistic; it translates into very real, tangible consequences for prospective students and their families. This hike can reshape educational aspirations, influence career choices, and strain household budgets. The financial burden can be particularly acute for those already struggling with the existing high costs of higher education, potentially leading to increased student loan debt and delayed financial independence.

For many, this news means a significant reassessment of college options. What was once considered an affordable state school might suddenly seem out of reach, prompting a search for even more economical alternatives or a deferment of higher education dreams. The decision-making process becomes less about academic fit or program strength and more about sheer financial viability, fundamentally altering the college selection paradigm.

Beyond the immediate financial strain, there are also long-term implications. Higher debt levels can delay major life milestones, such as buying a home, starting a family, or saving for retirement. This intergenerational transfer of financial stress impacts not only the students but also their parents, who often contribute significantly to tuition costs or cosign loans, thus tying their own financial futures to their children’s educational debts.

The Burden of Student Loan Debt

Student loan debt is already a national crisis in the US, and a 7% tuition increase will only exacerbate this problem. Many students rely heavily on loans to bridge the gap between their savings, financial aid, and the actual cost of attendance.

- Increased Borrowing: A higher tuition means students will likely need to borrow more, adding to their principal loan amount and, consequently, their interest payments over time.

- Longer Repayment Periods: Larger loan sums often necessitate extended repayment plans, keeping graduates in debt for a longer part of their adult lives.

- Delayed Financial Milestones: The burden of monthly loan payments can delay graduates from achieving common financial goals like purchasing a home or starting a family.

This increased reliance on debt can also influence students’ post-graduation career choices. They might feel pressured to pursue higher-paying jobs immediately, even if it means sacrificing passions or interests, simply to service their debt. This can lead to job dissatisfaction and, ironically, a less fulfilling outcome despite the significant investment in education.

Families, particularly those without extensive savings, will find themselves in a precarious position. The need to finance education may lead to difficult choices, like deferring retirement savings or taking on additional work, underscoring the broad societal impact of rising tuition. It’s a systemic issue that demands both individual preparedness and broader policy solutions to ensure higher education remains an accessible dream.

The psychological toll also cannot be overlooked. The constant financial pressure and uncertainty can affect students’ mental health, impacting their academic performance and overall well-being. This projected increase, therefore, isn’t just a financial challenge but a comprehensive societal issue with far-reaching consequences for the future generation.

Proactive Strategies for Saving for College

Given the looming 7% tuition increase, adopting proactive and diversified saving strategies is more important than ever. Relying solely on traditional savings accounts will likely fall short of covering the escalating costs. A multi-pronged approach that leverages various financial instruments and takes advantage of tax benefits can make a substantial difference in reaching college savings goals.

One of the most effective tools for college savings is the 529 plan. These state-sponsored investment plans offer tax advantages, allowing money to grow tax-free and withdrawals to be tax-free when used for qualified education expenses. The flexibility of 529 plans, including options for different risk tolerances and investment preferences, makes them a cornerstone of college savings for many families. It’s crucial to begin contributing early and consistently to maximize the power of compound interest.

Beyond formal savings plans, families can also explore other avenues. Setting up automatic transfers to a dedicated college fund, even if small, can build up significant capital over time. Engaging children in the saving process, perhaps by having them contribute a portion of gift money or earnings, can also instill financial literacy and personal responsibility, making the collective goal more attainable.

Leveraging 529 Plans and Other Investment Vehicles

The choice of investment vehicle can significantly impact the growth of college savings. While 529 plans are popular, other options may also fit into a well-rounded strategy.

- 529 College Savings Plans: These are the most common and often recommended. They offer tax-free growth and withdrawals for qualified education expenses, and some states even offer tax deductions for contributions.

- Custodial Accounts (UGMA/UTMA): These allow assets to be held for a minor, but the funds are transferred to the child’s control at age of majority, which might not be ideal for college funding if the child decides to use the money for other purposes.

- Coverdell Education Savings Accounts (ESAs): Similar to 529 plans, ESAs offer tax-free growth and withdrawals for education expenses, but they have income restrictions and lower contribution limits.

Diversifying investments within these vehicles is also important. Depending on the child’s age, families can adjust their risk tolerance, moving from more aggressive growth-oriented investments when the child is young to more conservative options as college approaches. This strategy helps protect accumulated savings from market volatility closer to the withdrawal date.

It’s also worth noting that some investments, like Roth IRAs, while primarily for retirement, can be used for education expenses without penalty under certain circumstances. While this isn’t their primary purpose, it offers an additional layer of flexibility for those who have maximized other college savings options.

Ultimately, the key is to start early, contribute regularly, and continuously review and adjust the savings plan to align with evolving financial circumstances and tuition projections. Every dollar saved today is one less dollar to borrow tomorrow, making the future burden of education more manageable in the face of rising costs.

Exploring Financial Aid and Scholarship Opportunities

In the face of rising tuition, financial aid and scholarships become indispensable tools for making higher education accessible. These resources can significantly reduce the out-of-pocket expenses for families, helping to bridge the gap created by increased tuition fees. Navigating the complex world of financial aid, however, requires diligence, early planning, and an understanding of the various types of assistance available.

The Free Application for Federal Student Aid (FAFSA) is the gateway to most federal and state financial aid, including grants, work-study programs, and federal student loans. Completing the FAFSA accurately and on time is paramount, as it determines eligibility for need-based aid. Families should pay close attention to deadlines and ensure all necessary documentation is prepared in advance.

Beyond government aid, scholarships are another critical component of reducing college costs. These are essentially free money that doesn’t need to be repaid. Scholarships are awarded based on a wide range of criteria, including academic merit, athletic talent, artistic ability, community service, specific fields of study, and even unique personal characteristics. The sheer volume of available scholarships means that almost every student has an opportunity to secure some form of award.

Maximizing Your FAFSA and Scholarship Applications

Securing financial aid and scholarships is a competitive process that benefits greatly from strategic planning and thorough execution. Simply applying isn’t enough; maximizing your chances requires attention to detail.

- Early FAFSA Submission: Since some aid is awarded on a first-come, first-served basis, submitting the FAFSA as early as possible after it opens on October 1st can increase your chances of receiving maximum aid.

- Thorough Research for Scholarships: Utilize online scholarship search engines, school financial aid offices, community organizations, and local businesses. Look for niche scholarships that might have fewer applicants.

- Crafting Strong Essays: Many scholarships require essays. These are opportunities to showcase your personality, achievements, and aspirations. Tailor each essay to the specific scholarship criteria.

Don’t overlook institutional aid from individual colleges. Many universities offer their own grants and scholarships, often based on a combination of merit and need. It’s always beneficial to communicate directly with college financial aid offices to understand their specific offerings and application processes.

Additionally, consider seeking professional help for financial aid planning. Consultants can provide guidance on optimizing your FAFSA submission, identifying overlooked scholarship opportunities, and understanding the fine print of various aid packages. Their expertise can be invaluable in navigating what can often feel like an overwhelming process.

The key takeaway is that financial aid and scholarships are not merely supplemental; they are often essential components of a viable college financing plan. By actively pursuing these opportunities, students can significantly reduce their financial burden, making the dream of higher education a more achievable reality even with rising tuition costs.

Considering Alternative Education Pathways

As college tuition costs continue their ascent, with a projected 7% increase in 2025, traditional four-year university degrees are becoming an increasingly difficult financial proposition for many. This economic reality is prompting a re-evaluation of educational pathways, leading many prospective students to explore viable and often more affordable alternatives. These alternative routes not only offer significant cost savings but can also provide specialized skills and quicker entry into the workforce, aligning with diverse career aspirations.

Community colleges often serve as an excellent starting point. They offer lower tuition rates than four-year universities and allow students to complete general education requirements before transferring to a university for their final two years. This “2+2” model can significantly reduce the overall cost of a bachelor’s degree without compromising academic quality or transferability of credits. Many community colleges also have strong relationships with local businesses, facilitating internships and job placements.

Another increasingly popular option is vocational or trade schools. These institutions provide hands-on training in specific, high-demand fields such as culinary arts, automotive technology, healthcare support, and skilled trades. Graduates often enter the workforce with specialized certifications and a practical skillset, commanding competitive salaries without the burden of extensive student loan debt. These programs are typically shorter and more focused, making them an attractive choice for those seeking direct career entry.

Vocational Training and Online Degrees

The evolution of the job market and educational technology has made vocational training and online degrees more relevant than ever. These options provide flexible and often more affordable paths to career success.

- Vocational Schools: Focus on practical skills for specific trades. They offer certificates or associate degrees in fields like welding, paralegal studies, nursing assistants, and IT support. The training is usually hands-on and job-oriented.

- Online Degree Programs: Many reputable universities now offer fully accredited online degrees. These can be more flexible for students who need to balance work or family commitments and often come with lower tuition costs, especially for out-of-state students who might qualify for in-state tuition rates for online programs.

- Apprenticeships: A blend of on-the-job training and classroom instruction, often paid. Apprenticeships can lead to highly skilled positions without any tuition debt, as employers often cover the training costs.

Micro-credentials, bootcamps, and specialized certification programs are also gaining traction. These shorter, intensive programs are designed to equip individuals with specific skills demanded by industries like tech, marketing, and data analysis. They are typically much less expensive than a traditional degree program and can open doors to entry-level positions or career changes quickly.

Ultimately, the “best” education pathway is subjective and depends on individual career goals, learning styles, and financial circumstances. With the projected tuition increases, embracing these alternative options is not a compromise but a strategic move towards a financially sound and professionally rewarding future. It encourages a broader view of education, one that values skill acquisition and practical application as much as traditional academic pursuits.

Advocacy and Policy Changes in Education Funding

The continuous rise in college tuition, underscored by the projected 7% increase in 2025, is not merely a problem for individual families; it’s a systemic issue requiring broader advocacy and policy interventions. While personal savings strategies are crucial, long-term affordability hinges on changes at the institutional and governmental levels. Engaging in advocacy and understanding potential policy shifts can empower individuals to contribute to a more equitable and accessible higher education landscape.

Advocacy efforts often focus on increasing state and federal funding for public universities. Historically, as state appropriations have declined, tuition fees have risen to compensate for budget shortfalls. Pushing for greater public investment can alleviate the pressure on universities to raise tuition, thereby making education more affordable for all. These efforts can involve contacting elected officials, participating in awareness campaigns, and supporting organizations dedicated to higher education reform.

Another key area of policy contention is student loan reform. High interest rates, complex repayment plans, and the burden of overwhelming debt significantly deter prospective students. Advocates push for lower interest rates, simplified repayment options, and expanded loan forgiveness programs. Such reforms would not only ease the financial stress on graduates but also make the initial investment in education less daunting, even with rising tuition costs.

Governmental and Institutional Responses to Rising Costs

Various stakeholders are exploring different approaches to address the escalating costs of higher education. These responses range from legislative actions to innovative university initiatives.

- Increased State Appropriations: Some states are beginning to reverse the trend of declining funding, recognizing the importance of public universities for economic development and social mobility.

- Tuition Freezes or Caps: A few states and institutions have implemented tuition freezes or caps to limit increases. While beneficial in the short term, this can strain university budgets if not accompanied by alternative funding sources.

- Income-Share Agreements (ISAs): An alternative to traditional student loans, where students agree to pay a percentage of their future income for a set period after graduation. This aligns the university’s incentive with student success.

Universities themselves are also exploring innovative models to manage costs and provide value. This includes offering more online courses, developing accelerated degree programs, and focusing on partnerships with businesses to provide practical, applied learning experiences that reduce the time and expense of a traditional degree. Some institutions are also re-evaluating their operational efficiency to cut down on administrative overhead without compromising educational quality.

Furthermore, discussions around tuition transparency and accountability are gaining momentum. Policies that require clearer breakdown of costs and demonstrate how tuition funds are utilized can help students and families make more informed decisions. It can also incentivize universities to be more judicious with their spending, ensuring that increases are justified and provide tangible benefits to the student body.

The collective effort of students, families, educators, and policymakers is essential to tackle the systemic challenges of college affordability. While the projected 7% increase in 2025 is concerning, it also serves as a catalyst for renewed advocacy and a push for sustainable solutions that ensure higher education remains an engine of opportunity.

Long-Term Financial Planning for Educational Futures

The news of a projected 7% increase in college tuition for 2025 solidifies the notion that planning for higher education is a marathon, not a sprint. It demands not just immediate action but a robust, adaptable, and long-term financial strategy. Effective long-term planning goes beyond simply saving; it involves a holistic approach that considers future financial goals, potential market shifts, and evolving educational landscapes.

One critical aspect of long-term planning is continuously re-evaluating your financial situation and college savings targets. Economic conditions change, investment returns fluctuate, and your family’s income and expenses may shift. Regular reviews, perhaps annually, allow for necessary adjustments to contribution levels, investment allocation, and overall strategy. This proactive monitoring ensures that your plan remains aligned with your objectives and the fluid reality of educational costs.

Moreover, consider the broader financial picture. College savings should ideally be integrated into your overall financial plan, which includes retirement savings, emergency funds, and other significant financial goals. While education is a high priority, it shouldn’t entirely derail other crucial aspects of financial security. Balancing these competing demands requires careful budgeting and prioritizing, often with the guidance of a financial advisor.

Diversifying Investment Strategies and Seeking Professional Advice

To navigate the complexities of long-term educational funding, relying on a single approach is often insufficient. Diversification in investment strategies and professional guidance are key components.

- Balanced Investment Portfolio: While a 529 plan is excellent, consider diversifying college savings across different types of investments, potentially including standard brokerage accounts or even real estate, if appropriate for your financial situation.

- Regular Review and Rebalancing: As your child approaches college age, gradually shift investments from higher-risk growth assets to more conservative, capital-preserving options to protect accumulated savings from market downturns.

- Consulting Financial Advisors: A qualified financial advisor can provide personalized guidance, helping you understand tax implications, choose appropriate investment vehicles, and create a comprehensive long-term plan tailored to your specific circumstances and risk tolerance.

Furthermore, educating yourself about financial aid trends, potential changes in education policy, and economic forecasts can provide valuable insights. The more informed you are, the better equipped you’ll be to anticipate challenges and make strategic decisions. Attending webinars, reading financial planning guides, and staying current with news in higher education financing can be incredibly beneficial.

Finally, fostering open communication within the family about college costs and financial expectations is vital. Preparing children for the financial realities of higher education can include discussions about their role in securing scholarships, choosing cost-effective schools, or even working part-time. This collective awareness and shared responsibility can significantly ease the financial pressure and ensure a more collaborative approach to achieving educational goals in the long run.

| Key Point | Brief Description |

|---|---|

| 📈 Tuition Hike | College tuition costs are projected to increase by 7% in 2025, demanding immediate financial planning. |

| 💰 Saving Strategies | Leverage 529 plans, custodial accounts, and consistent contributions to accumulate funds. |

| 🎁 Financial Aid & Scholarships | Maximize FAFSA submissions and actively seek scholarships to reduce out-of-pocket costs. |

| 🛤️ Alternative Pathways | Consider community colleges, vocational schools, and online degrees for more affordable education. |

Frequently Asked Questions About College Tuition Costs

College tuition increases are driven by several factors, including general inflation, rising operational costs for universities, decreased public funding from states, and the demand for advanced facilities and technology. These elements collectively contribute to the upward trend in educational expenses.

A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs. Contributions grow tax-free, and withdrawals for qualified educational expenses are also tax-free, providing a significant advantage over traditional savings accounts for college funding.

To maximize scholarships, start searching early, apply for a wide range of awards, thoroughly research eligibility requirements, and craft compelling essays tailored to each scholarship. Utilize online search engines, school financial aid offices, and local community resources for opportunities.

Absolutely. Alternative pathways such as community colleges, vocational schools, and online degrees often offer more affordable tuition and quicker entry into the workforce. They provide specialized skills and flexibility, making them excellent choices for many students, especially with rising traditional tuition costs.

Advocacy and policy changes are crucial for long-term college affordability. Efforts include pushing for increased state and federal funding for public universities, reforming student loan interest rates, and promoting tuition transparency. These systemic changes can significantly reduce the financial burden on students and families.

Conclusion

The projected 7% increase in college tuition costs for 2025 serves as a potent reminder of the ever-present financial challenges in higher education. While this news may seem daunting, it also galvanizes the imperative for proactive and strategic planning. By understanding the underlying economic forces, diligently pursuing diversified savings strategies like 529 plans, exhaustively exploring financial aid and scholarship opportunities, and considering innovative alternative education pathways, students and families can significantly mitigate the impact of rising costs. Moreover, engaging in advocacy for broader policy changes is vital for fostering a more accessible and equitable educational future for all. The journey to higher education remains a substantial investment, but with informed decisions and strategic preparation, it remains an achievable and rewarding endeavor.