Federal Student Loan Forgiveness: Latest Updates on Eligibility & Deadlines

The Latest on Federal Student Loan Forgiveness: Eligibility Requirements and Application Deadlines encompass recent policy changes, updated requirements for borrowers, and crucial deadlines to meet for potential debt relief.

Staying informed about the latest on federal student loan forgiveness: eligibility requirements and application deadlines is crucial for borrowers seeking debt relief. This article provides a comprehensive overview of the current landscape, helping you navigate the complex process and understand your potential eligibility.

Understanding Federal Student Loan Forgiveness Programs

Federal student loan forgiveness programs offer pathways for borrowers to have their remaining loan balance canceled after meeting certain requirements. These programs are designed to assist individuals working in public service or facing specific financial hardships.

Types of Federal Student Loan Forgiveness

Federal student loan forgiveness comes in many forms, each with its own set of requirements. Here are the main types:

- Public Service Loan Forgiveness (PSLF): For those employed by qualifying non-profit or government organizations.

- Teacher Loan Forgiveness: Available to teachers who serve in low-income schools for a certain number of years.

- Income-Driven Repayment (IDR) Forgiveness: After 20 or 25 years of payments under an income-driven repayment plan.

Key Differences Between Forgiveness Programs

The core differences between these forgiveness programs lie in their eligibility criteria and the length of time it takes to qualify. PSLF focuses on employment type, Teacher Loan Forgiveness on profession and location, and IDR forgiveness on the repayment plan and duration. Understanding these distinctions is essential for choosing the right path to potential loan forgiveness. Borrowers should research criteria carefully to determine the best strategy for their circumstances.

Understanding the intricacies of these federal student loan forgiveness programs is essential for borrowers seeking relief from their debts. Each program has specific requirements and application procedures, and it’s important to know the differences to maximize your chances of approval.

Navigating Eligibility Requirements for Loan Forgiveness

Eligibility requirements for federal student loan forgiveness programs can often be complex and confusing. Borrowers need to understand the specific criteria for each program, including employment qualifications, loan types, and repayment plans.

Public Service Loan Forgiveness (PSLF) Eligibility

To qualify for PSLF, you must be employed full-time by a qualifying non-profit or government organization. Only certain types of federal student loans qualify, so consolidating your loans might be necessary. You also need to make 120 qualifying monthly payments under a qualifying repayment plan while working for a qualifying employer.

Income-Driven Repayment (IDR) Forgiveness Eligibility

IDR forgiveness is available after 20 or 25 years of payments under an income-driven repayment plan, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), or Saving on a Valuable Education (SAVE). The specific repayment timeline depends on the plan and when the loan was initially disbursed. Your payments will be based on your income and family size. After the specified period, the remaining balance is forgiven.

Teacher Loan Forgiveness Eligibility

The requirements for Teacher Loan Forgiveness include teaching full-time for five consecutive years in a low-income school or educational service agency. Certain types of loans are ineligible; specifically, loans taken out for “forgiveness” purposes do not qualify. The maximum amount that can be forgiven is $17,500 for highly qualified math, science, or special education teachers, and $5,000 for other qualified teachers. Compliance with these eligibility mandates is essential for potential loan forgiveness.

Therefore, borrowers should scrutinize eligibility mandates to assure that all measures for proper validation and acceptance are fulfilled. Precise alignment with eligibility requirements improves a borrower’s chances of achieving loan forgiveness through these federal programs.

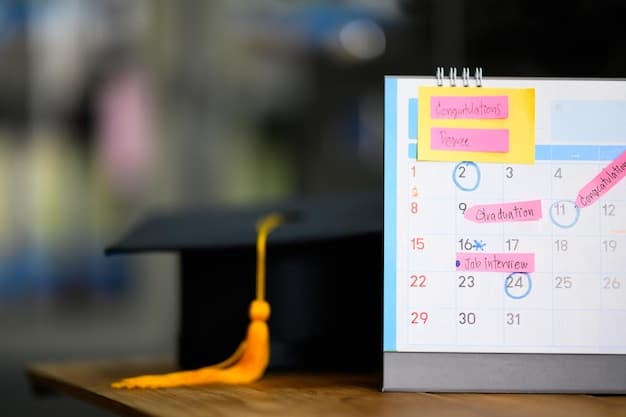

Important Application Deadlines and Timelines

Staying aware of application deadlines and program timelines is essential for anyone seeking federal student loan forgiveness. Missing deadlines can lead to disqualification, potentially costing borrowers significant financial relief.

Key Application Deadlines to Watch For

Several federal student loan programs have specific application deadlines that applicants must meet. Some programs have annual deadlines, while others may have periodic enrollment windows.

- PSLF Limited Waiver: Although the limited PSLF waiver deadline has passed, it’s crucial to stay updated on any future opportunities or changes to the program.

- SAVE Plan Enrollment: There’s no hard deadline to enroll in the SAVE plan; however, enrolling sooner allows you to receive benefits immediately.

- Teacher Loan Forgiveness Application: Applications can be submitted anytime after completing the five consecutive years of qualifying teaching service.

Tips for Staying on Track with Timelines

Staying abreast with specific application timelines is extremely crucial in leveraging the loan forgiveness programs. A great tip is to make a timeline so you can track your progress. This will help ensure you meet all deadlines.

Borrowers also need to be prepared to provide all documentation needed to complete the process. Getting documents together ahead of application dates will ensure all pieces of the puzzle are in place beforehand.

Keeping deadlines top-of-mind can make a big difference for students seeking to have their student loans forgiven. When deadlines are met, students will be able to capitalize on potential savings and avoid missing out!

The Impact of Policy Updates on Loan Forgiveness

Federal student loan forgiveness policies are subject to change based on legislative actions and executive decisions. These policy updates directly impact the eligibility requirements, application processes, and overall availability of loan forgiveness programs.

Changes in federal student loan forgiveness policies can have significant implications for borrowers. Staying informed about policy updates, understanding their impact, and seeking guidance from reliable sources is crucial for maximizing the benefits of loan forgiveness programs. By being proactive and adaptable, borrowers can navigate the evolving landscape of student loan forgiveness and work toward achieving financial relief. The information provided in this article is for educational purposes and should not be considered legal or financial advice.

Recent Changes to Student Loan Forgiveness Programs

Recent changes to student loan forgiveness programs include adjustments to income-driven repayment plans and modifications to the eligibility criteria for Public Service Loan Forgiveness (PSLF). For instance, the introduction of the SAVE plan and the limited PSLF waiver demonstrate the Biden administration’s efforts to make loan forgiveness more accessible.

How Policy Changes Affect Borrowers

Policy changes can lead to expanded eligibility, simplified application processes, or increased forgiveness amounts. However, they can also result to stricter requirements, reduced benefits, or program suspensions. It’s crucial for borrowers to understand how these changes affect their eligibility and repayment options. Staying informed about policy updates can help borrowers take advantage of new opportunities or mitigate potential drawbacks. A thorough understanding of what’s happening will make compliance with any program’s guidelines more attainable.

Changes to federal student loan policies can significantly impact borrowers, making it crucial to stay informed and adapt to new requirements and opportunities. Understanding the latest updates can help you make sound decisions about your student loan repayment strategy.

Strategies for Maximizing Your Loan Forgiveness Potential

To maximize your potential for federal student loan forgiveness, it’s essential to develop proactive strategies and take advantage of available resources. Understanding the specific requirements of each forgiveness program and tailoring your approach accordingly is key.

Assessing Your Eligibility

Start by thoroughly assessing your eligibility for each available loan forgiveness program. Research the criteria for PSLF, Teacher Loan Forgiveness, and income-driven repayment plans. Determine which programs align with your employment situation, loan types, and repayment goals. Gather all the necessary documentation, such as employment records, loan statements, and income information. This upfront assessment will help you focus your efforts on the programs you are most likely to qualify for.

Making Informed Decisions

Consider options like consolidating federal student loans to qualify for forgiveness programs with specific loan requirements. Ensure you are enrolled in a qualifying income-driven repayment plan that aligns with your financial situation and long-term goals. By carefully evaluating your options and taking proactive steps, you can significantly increase your chances of receiving the loan forgiveness you deserve.

- Carefully evaluate the eligibility requirements for each program.

- Consolidate your federal student loans if necessary.

- Enroll in a qualifying income-driven repayment plan.

Maximize your student loan forgiveness potential by proactively assessing your situation, making informed decisions, and seeking expert guidance when needed.

Seeking Professional Guidance and Resources

Navigating the complexities of federal student loan forgiveness can be challenging, making professional guidance and reliable resources invaluable. Consulting with financial advisors, student loan experts, and non-profit organizations can provide borrowers with the support and information they need.

Benefits of Professional Consultation

Seeking advice from a financial advisor or student loan expert can provide clarity on your eligibility, program options, and repayment strategies. Professionals can help you navigate the application process, optimize your loan forgiveness potential, and avoid costly mistakes. They can guide you through the complexities of income-driven repayment plans, loan consolidation, and other considerations.

Reliable Resources for Information

The U.S. Department of Education’s website provides detailed information about federal student loan programs, eligibility requirements, and application processes. Non-profit organizations like The Institute of Student Loan Advisors (TISLA) offer free resources and counseling to borrowers. These resources can help you stay informed about policy updates, program changes, and best practices for managing your student loans.

Seeking professional guidance and utilizing reliable resources are crucial steps in navigating the complexities of federal student loan forgiveness. Informed decision-making ensures borrowers are well-equipped to maximize their benefits.

| Key Point | Brief Description |

|---|---|

PSLF Eligibility PSLF Eligibility |

Full-time employment with a qualifying non-profit or government organization. |

Application Deadlines Application Deadlines |

Stay updated on specific program deadlines to ensure timely submission. |

Income-Driven Repayment Income-Driven Repayment |

Forgiveness after 20-25 years of payments, based on income and family size. |

Teacher Loan Forgiveness Teacher Loan Forgiveness |

Five consecutive years teaching in a low-income school; up to $17,500 forgiven. |

Frequently Asked Questions

▼

▼

▼

▼

▼

Conclusion

Staying informed about the latest on federal student loan forgiveness: eligibility requirements and application deadlines is critical for borrowers seeking debt relief. By understanding the specific requirements of each program, staying up-to-date with policy changes, and seeking professional guidance when needed, you can maximize your potential for loan forgiveness and take control of your financial future.